What Is Tax Fringe On W2 . if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Although there are special rules. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. They’re designed to improve the overall employee experience and.

from www.remotefinancialplanner.com

They’re designed to improve the overall employee experience and. Although there are special rules. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be.

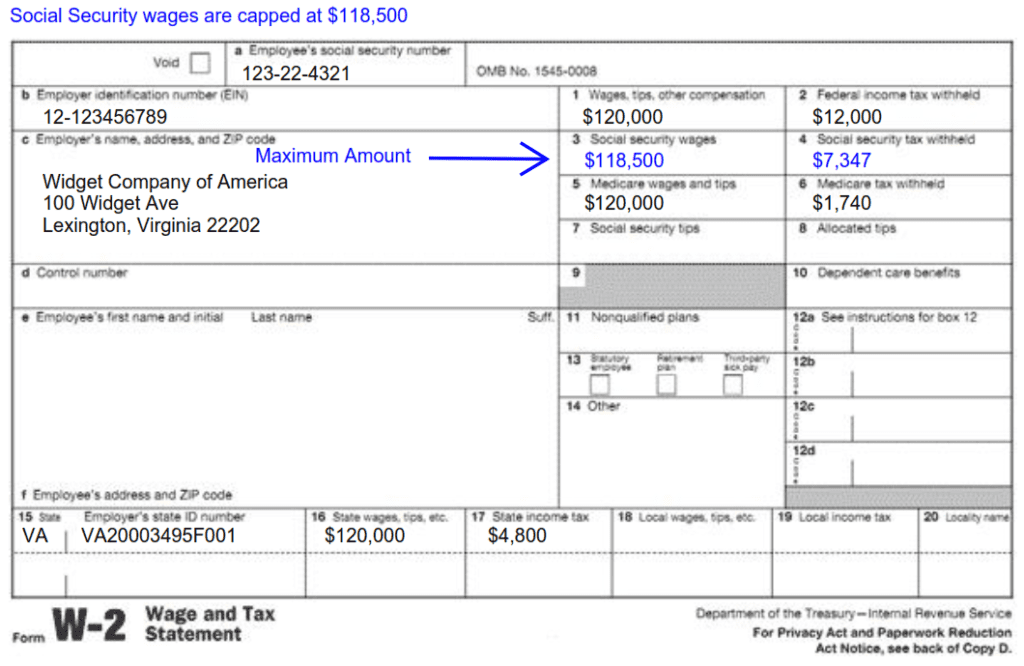

Understanding Tax Season Form W2 Remote Financial Planner

What Is Tax Fringe On W2 Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. Although there are special rules. They’re designed to improve the overall employee experience and. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable.

From sao.wyo.gov

W2 to Paystub Reconciliation Wyoming State Auditor's Office What Is Tax Fringe On W2 They’re designed to improve the overall employee experience and. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Although there are special rules. if the recipient of a taxable fringe benefit is your. What Is Tax Fringe On W2.

From www.peoplekeep.com

Guide to tax withholdings for stipends and fringe benefits What Is Tax Fringe On W2 the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Although there are special rules. fringe benefits that do not meet. What Is Tax Fringe On W2.

From smartworkpapershelp.hownowhq.com

Fringe Benefits Tax Smart Workpapers Help & Support What Is Tax Fringe On W2 the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Although there are special rules. fringe benefits that do not meet any statutory requirements. What Is Tax Fringe On W2.

From www.remotefinancialplanner.com

Understanding Tax Season Form W2 Remote Financial Planner What Is Tax Fringe On W2 fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles.. What Is Tax Fringe On W2.

From www.altoadvisors.com.au

Insights Fringe Benefits tax What, why, when and who? Alto What Is Tax Fringe On W2 if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their. What Is Tax Fringe On W2.

From sao.wyo.gov

W2 to Paystub Reconciliation Wyoming State Auditor's Office What Is Tax Fringe On W2 fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Although there are special rules. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. Determine the value of the employee fringe benefits by january 31 of the year after you. What Is Tax Fringe On W2.

From mallorywkora.pages.dev

Irs W2 Form 2024 Printable Bettye Nancey What Is Tax Fringe On W2 Although there are special rules. the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. if the recipient of a taxable fringe benefit is your employee, the benefit is. What Is Tax Fringe On W2.

From www.originbc.com.au

Understanding Fringe Benefits Tax What Is Tax Fringe On W2 fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Determine the value of the employee fringe benefits by january 31 of the year after you give. What Is Tax Fringe On W2.

From www.bishopcollins.com.au

What is Fringe Benefits Tax (FBT)? Collins What Is Tax Fringe On W2 fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Although there are special rules. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. some taxable fringe benefits include cash bonus pay, paid personal time. What Is Tax Fringe On W2.

From www.pherrus.com.au

How Does Fringe Benefits Tax Work Pherrus What Is Tax Fringe On W2 fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. if the recipient. What Is Tax Fringe On W2.

From taxleopard.com.au

What is Fringe Benefits Tax and How Does it Work? TaxLeopard What Is Tax Fringe On W2 Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. the value of a fringe benefit is subject to a number of taxes, including federal income tax, social. What Is Tax Fringe On W2.

From www.slideshare.net

Fringe Benefits Tax What Is Tax Fringe On W2 the value of a fringe benefit is subject to a number of taxes, including federal income tax, social security tax, medicare tax, and futa. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Although there are special rules. fringe benefits are supplementary perks, incentives,. What Is Tax Fringe On W2.

From www.kpgtaxation.com.au

What Is Fringe Benefits Tax & How It Works? What Is Tax Fringe On W2 They’re designed to improve the overall employee experience and. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. the value of a fringe benefit is subject to a number of taxes, including federal. What Is Tax Fringe On W2.

From eadaqloraine.pages.dev

W2 Form For 2024 Faina Jasmina What Is Tax Fringe On W2 if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. Although there are special rules. fringe benefits that do not meet any statutory requirements for. What Is Tax Fringe On W2.

From carbongroup.com.au

Quick Guide To Fringe Benefits Tax And Employee Rewards Carbon Group What Is Tax Fringe On W2 if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Although there are special rules. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. the value of a fringe benefit is subject to a number of. What Is Tax Fringe On W2.

From www.slideserve.com

PPT TxEIS 2013 w2 checklist PowerPoint Presentation, free download What Is Tax Fringe On W2 They’re designed to improve the overall employee experience and. if the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. the value of a fringe benefit. What Is Tax Fringe On W2.

From www.studypool.com

SOLUTION Fringe benefit tax ppt Studypool What Is Tax Fringe On W2 Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. They’re designed to improve the overall employee experience and. Although there are special rules. some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles. the value of a fringe. What Is Tax Fringe On W2.

From una-acctg.com

What You Need to Know About Fringe Benefits Tax What Is Tax Fringe On W2 They’re designed to improve the overall employee experience and. fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. Although there are special rules. Determine the value of the employee fringe benefits by january 31 of the year after you give them to your employees. the value of a fringe benefit is subject to. What Is Tax Fringe On W2.